CFOs and banks prepare for the blockchain future of finance

Blockchain has much more to offer the financial world than just cryptocurrencies and a wealth of new developments in the industry look set to accelerate the global economy – if leaders can attract the right talent to implement the new technologies.

Central banks must play a leading role in shaping the new landscape, say analysts. This may come about with the use of Central Bank Digital Currencies (CBDCs). CBDCs would offer secure and instantaneous settlement through consumer banks and trusted payment intermediaries, says Accenture, using tokens in the digital world as they would hard currencies in the real world.

Tokenisation and decentralisation are critical in the new world of finance and have already emerged as a format to represent goods, assets and rights. Payment applications for CBDC can be used in retail, wholesale and cross-border transactions, although the details of these will differ depending on local circumstances, says Accenture. It is hoped this will minimise fragmentation and establish a strong foundation.

A recent study by Juniper Research found that the total number of tokenised payment transactions is expected to exceed 1 trillion globally by 2026; a 58% rise from 680 billion in 2022 over the next four years. Juniper says this growth will come from the rise of ‘one-click’ solutions that use card-on-file tokenisation to store a customer’s payment credentials; enabling them to auto-fill and complete transactions with a single click.

Blockchain breaks down silos in finance industry

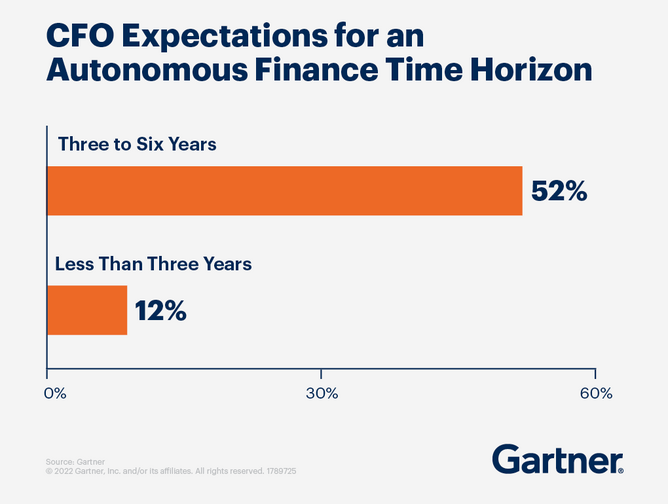

All areas of the financial sector will benefit from the new technologies and workflows, according to Gartner, who say CFOs must be fluent in blockchain by 2025. A distributed ledger approach creates better insights leading to better decisions based on trusted data, says Gartner. It also provides a single source – the “golden copy”, as they call it, which removes obstacles by making transactions visible and open to easy collaboration.

Blockchain breaks down silos and creates a more fluid ecosystem, says Gartner. Speed and efficiency also mean finance leaders can quickly reallocate capital based on changing business needs.

But leaders face a battle for the right talent — 47% of CFOs told Gartner they find it difficult to find and hire enterprise talent. CFOs should work more closely with human resources departments to define digital skills and rethink how to retain this in-house over time.

Health insurance is ripe for revolution as it is resource-intensive with inefficient processes – the US health insurance market alone will see the number of claims processed via blockchain climb from two million in 2021 to 24 million by 2024, according to a survey released by Juniper Research this year.

The report, Blockchain in Financial Services: Key Opportunities, Vendor Strategies & Market Forecasts 2021-2030, found the insurance sector will see cost savings from blockchain use across all processes. Insurance is a complex, often inefficient area of business, says the report, and blockchain offers advantages through equitable data access and fighting fraud with increased data transparency.

But stakeholders need to overcome barriers and legacy thinking – insurers have previously been reluctant to modernise existing processes, says Juniper Research, and there are currently no global standards around blockchain networks.

Research author Susannah Hampton added: "Insurers must address barriers to implementing blockchain technology through investment and partnerships. Any blockchain solutions deployed must integrate into existing underwriting and claims management platforms and offer an increased value proposition beyond what is already possible."

- BAE Systems: Education key to Tackling Technology Skills GapDigital Transformation

- British Army’s First CTO to Drive its Technology StrategyDigital Transformation

- GFT & Google Cloud Gen AI to Power Next-Gen Customer ServiceAI & Machine Learning

- How BlackBerry & AMD are Transforming the Robotics IndustryAI & Machine Learning